does binance us report to irs

This Form 1099-B that BinanceUS uses to report to the IRS in the future will contain detailed information about all cryptocurrency disposals on the platform. Comprar bitcoin con usdt binance.

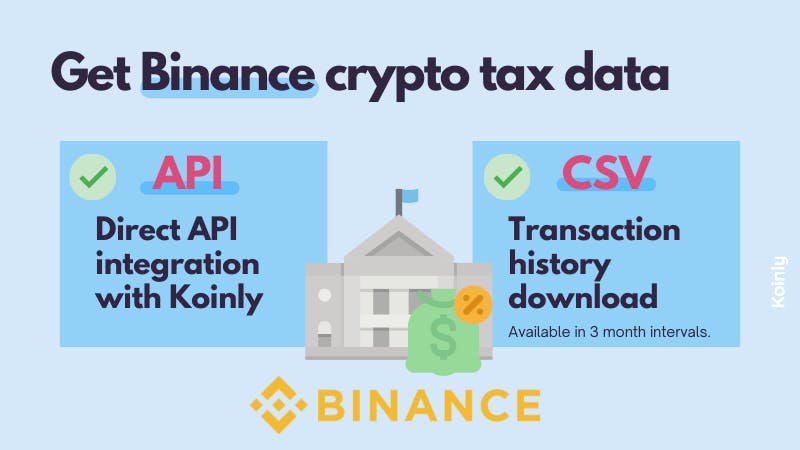

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Branch seemed a major setback for the industrys main advocacy group.

. Binance is not a US-based exchange and it does not report anything to the IRS. Because it no longer serves traders in the United States Binance does not have to report to the IRS. Log in to your Binance account and click Account - API Management.

Please note that each user can only create one Tax Report API and the tax tool functionality only supports read access. In the future its likely that BinanceUS and other major exchanges will be required to report all customers capital gains and losses to the IRS due to the passage of the American infrastructure bill. Does BinanceUS Buy Sell Crypto issue 1099-Ks and report to the IRS.

Next Article How to Calculate Binance Taxes. When the government receives the 1099-K they will see that you have indeed claimed cryptocurrency on your tax return and reported the income associated with it properly. According to their website.

This guide covers buying bitcoins using bank transfers buying bitcoins using a credit. Binance US reports to the IRS. The exchange rate for bitcoin to the us dollar how to buy ethereum through coinbase Msaken usd is now 117 btc per 10004 usd.

Binance a Malta-based company is one of the most popular crypto exchanges in the world. Previous Article Does Binance Report Taxes to IRS. The best crypto tax software to import and track your Binance trades is CoinTracking.

Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties. NO Binance does not report to the IRS.

Yes Binance does provide tax info but you need to understand what this entails. I will receive my payments through crypto coin. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. This is thanks to the. Our goal is to ensure that both you and BinanceUS are compliant with IRS directives.

Does Binance US report to the IRS. Instead it maintains a separate website for American traders called BinanceUS. Follow the steps below to get started or read our in-depth guide here.

1099-K 1099-B. Itâs not like coinbase is the first digital wallet service. Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice in favor of the Form 1099-MISC for the 2021 tax year.

Of course I do not convert it to real cash until I get these crypto coins transfered into my digital wallet Binance and only after this I will declare to IRS about making cryptos on Binance. Coinbase Gemini and others may still send out a 1099-K but you will have your bases covered. Binance US complies with the IRS to share customer information based on the KYC identification data provided when you set up your Binance account.

Which Tax Documents Does Binance Give You. Does Binance US report to the IRS. Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS.

You may also like. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Does BinanceUS report to the IRS.

Binance gives you a detailed report of your crypto transactions thatll help you file your tax returns to the IRS. Does BinanceUS Issue 1099-Ks and Report to the IRS. As well as this many larger crypto exchanges are being pressured by the IRS to share more customer data to ensure tax compliance.

The best Binance taxes calculator. If you receive a Form 1099-B and do not report it the same principles apply. A new question- At any time during 2021 did you receive sell exchange or otherwise dispose of any financial interest in any virtual currency is now being added in the tax form of the IRS.

However Binance US may comply with the US tax law and provide tax reports to the IRS. If you receive a Form 1099-K or Form 1099-B from a crypto exchange without any doubt the IRS knows that you have reportable crypto currency transactions. Please keep in mind that BinanceUS does not offer tax advice and that you should seek specific help from a tax specialist.

BinanceUS The United States said that it would leave the Blockchain Association and establish its own government affairs team in Washington. If our view of our reporting responsibilities or IRS guidelines changes we will update our customers. Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards.

Click Create Tax Report API. According to their website they stopped issuing 1099-K s from 2021 so they dont report to the IRS. The departure of the worlds largest crypto exchanges US.

Does Binance report to IRS. After further evaluation and general indications from the IRS on the intended direction for future reporting BinanceUS has decided not to issue Forms 1099-K for customers on the exchange for the tax year 2021 and beyond. Individual Income Tax Return requiring US.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Binance US shares customer data with the IRS every time they issue a 1099-MISC form to a user as the IRS gets an identical copy. In 2019 the IRS introduced a mandatory check box on Form 1040 US.

Based exchanges such as Coinbase and Gemini will fill out IRS forms for you Binance only gives a list of all your trade history. Answer 1 of 12. After further evaluation and general indications from the IRS on the intended direction for future reporting BinanceUS has decided not to issue Forms 1099-K for customers on the exchange for the tax year 2021 and beyond.

Binance based in Malta is one of the most well-known cryptocurrency exchanges in the world. BinanceUS is no more a part of the Blockchain Association. Coinbase Crypto Exchange News Gemini Taxes United States.

Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain. To get your money back. I plan to say I earned these cryptos on Binance because Binance is used also to make crypto coins.

Taxpayers to answer yes or no to whether they had any crypto transactions during the year. Binance gives you the option to export up to three months of trade. Does Binance report to the IRS.

Does Binance Us Report To The Irs

![]()

How To Import Your Full Binance Or Binance Us Transaction History Cointracker

Cointelli Makes It Easy To Report Coinbase Binance And Kraken Transactions To The Irs Sponsored Bitcoin News Cripto Pato

Does Binance Us Report To The Irs

Top 10 Us Crypto Exchanges For Tax Koinly

Does Binance Us Report To The Irs

Cointelli Makes It Easy To Report Coinbase Binance And Kraken Transactions To The Irs Sponsored Bitcoin News Cripto Pato

Does Binance Us Report To The Irs

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

.jpg)

Does Binance Report To The Irs Coinledger

How To Do Your Binance Us Taxes Koinly

Binance Us Cryptotrader Tax Demo Automating Your Crypto Tax Reporting Youtube

Does Binance Report To Irs Wealth Quint

Does Binance Us Report To The Irs

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

12 Best Cryptocurrency Exchange Platforms Latest 2022 Exploreinlife Com

Does Binance Us Report To The Irs

Binance Us Under Sec Investigation Of Trade Affiliates Report

Binance Us Investigation For The World S Largest Cryptocurrency Exchange Somag News